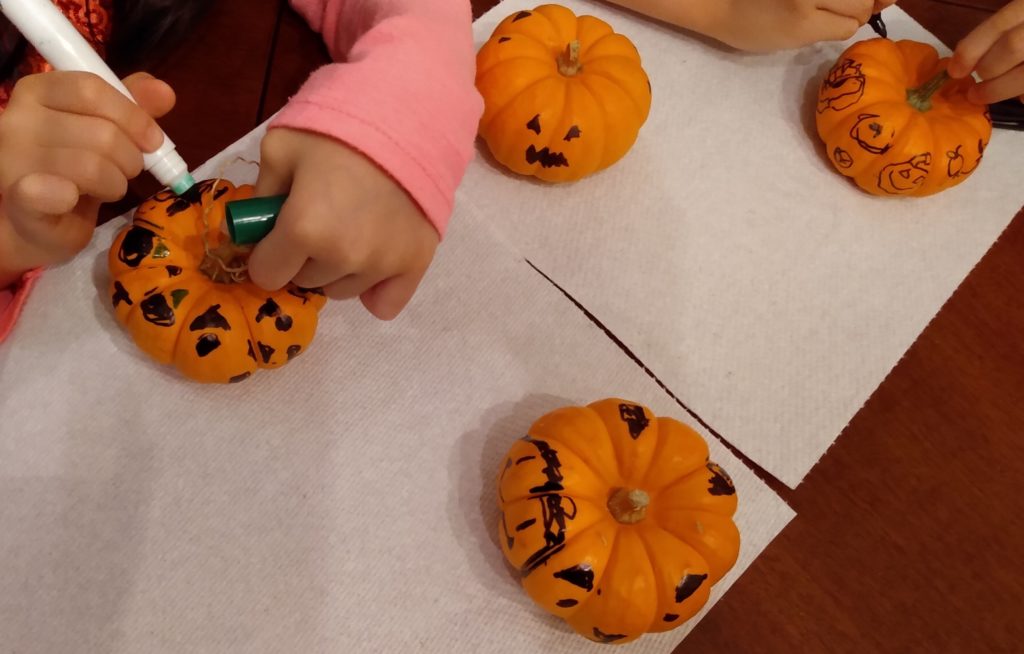

Hope you all had a Happy Halloween! The weather is getting colder here in Central NJ, and we’re busting out the jackets and gloves.

Hope you all had a Happy Halloween! The weather is getting colder here in Central NJ, and we’re busting out the jackets and gloves.

We’re happy to report that we solved last month’s crazy electrical bill mystery. We also hit a net worth milestone of $2.5 million! We reached this number for the first time ever. It feels unreal, but we’re grateful for it.

Here’s our monthly financial update for October.

Monthly Spending and Income

October 2021 Spending

| Primary Residence – Property Tax+Assoc. Fees | $2,446 |

| Rental – Property Tax+Assoc. Fees | $215 |

| Internet | $40 |

| Cell Phone | $123 |

| Gas + Electric | $23 |

| Water/Sewer | $0 |

| Food (Groceries/Household) | $933 |

| Food (Eating Out) | $496 |

| Transportation [Gas, Oil Change] | $168 |

| Car Insurance | $1035 |

| Life/Home/Umbrella Insurance | $90 |

| Health/Dental Insurance | $30 |

| Misc/Buffer [Netflix, Mini-Golf, Cash, Doctor/Meds, Cricket Snafoo] | $457 |

| Total Monthly Spending | $6,056 |

Our grocery and dining out expenses are in line with our expectations. Counting this month, our new average monthly grocery/household spending is $1,067. Our eating-out totals average about $433 per month for 2021.

We solved the mystery of the outrageously high electricity bill from September! It turns out that, even in this day and age, electricity meters are still being read manually. A person literally comes out every month and reads our meter. Like all humans, that person is prone to error, and he or she made a mistake reading the second most significant digit on our meter. That’s why our bill was more than twice our highest bill ever, even in a non-peak month like September. It blows my mind that this isn’t automated! It seems like it should be do-able to train some machine learning models to read the meter from a photo, rather than relying on someone to read each dial on each meter. In any case, we called to report the error. That’s why this month we paid nothing for electric, and we still have a credit balance to be applied to subsequent months. Whew!

No health insurance premium to pay this month, thanks to overpaying last month. We still have a credit remaining here too, so we expect to pay a small amount for next month as well.

We paid property tax on our primary residence, along with our 6-month car insurance premium. Since the pandemic started we’ve been driving so little. I think we total less than 10k miles annually for both our cars since Mr. FD starting working from home last year. Yet, we pay more than $2k per year for the insurance alone. I think part of the reason it’s so high is that we have an umbrella insurance policy that requires us to have high coverages for both cars. It’s probably wise for us to start looking into quotes elsewhere, but I’m dreading it because we currently have both cars, both homes, and an umbrella policy bundled with the same provider. I’m not looking forward to speaking with a representative about all of those at once.

In our miscellaneous spending, we had a few doctor’s appointments, and we purchased some medication as a result. We withdrew $100 just to have cash on hand. I think that’s the second time we’ve withdrawn money from the ATM during the entire pandemic, and the first time was just 20 one dollar bills for the “tooth fairy”. We had a big mini-golf excursion before the weather gets too cold. And, there was a bit of a headache with Cricket Wireless. I basically paid $180 for a phone that I eventually returned. Customer Service was atrocious, and I’m waiting for the $180 to be refunded. Sigh.

October 2021 InCOME

| Rent | $1,315 |

| Child Tax Credit (Federal) | $500 |

| Hobby Site | $368 |

| Mr. FD Freelance | $7,035 |

| Total Monthly Income | $9,218 |

As always, Mr. FD’s freelance income was pretty decent. He’s been cutting down on hours since school started for our kids. Even still, we’re bringing in more than we need and saving even more than that. Rent came in as expected, but we had some small maintenance to pay for. The hobby site brought in a decent amount, but it was offset by the hosting expenses; we paid in bulk for the next 3 years. Finally, we had another month of Advance Child Tax Credits to round out our income for October. It was a good month, overall.

OCTOBER 2021 RETIREMENT CONTRIBUTIONS

| Solo 401k Contributions |

| $4,240 |

Mr. FD contributed to his Solo 401k as usual. By subtracting our expenses from our income and retirement contributions, we were able to save this month.

October Savings: $9,218 – $6,056 + $4,240 = $7,402 in total

Spending and Savings Summary for the year

Here’s a table of our spending and savings for this year.

| Spending | Saving | |

| January 2021 | -$4,977 | $6,259 |

| February 2021 | -$4,288 | $3,632 |

| March 2021 | -$2,567 | $11,802 |

| April 2021 | -$5,632 | $1,591 |

| May 2021 | -$3,271 | $9,888 |

| June 2021 | -$3,207 | $9,880 |

| July 2021 | -$4,850 | $11,881 |

| August 2021 | -$3,403 | $806 |

| September 2021 | -$6,837 | $8,896 |

| October 2021 | -$6,056 | $7,402 |

| TOTAL | -$45,088 | $72,038 |

Net Worth for the year

For net worth, here’s how we’ve been doing. I calculate net worth near the end of the month, but not always on the final day of the month. Most of our net worth changes are heavily dependent on the stock market. I’m also including our total FIRE assets, which are invested and expected to grow in our retirement.

Our net worth went up by just under 60k this month, and our FIRE assets went up about the same. This is mainly from the markets being at all time highs. Year-to-date, our net worth is up roughly $340k. For us, that’s more than 6 years worth of expenses. When I look at graphs that track the performances of the major stock indexes, it really doesn’t make sense to me how much it’s gone up in recent years. For now, I’m amazed and happy and grateful to be in this position.

I’d like to reflect a little on reaching our $2.5 million net worth milestone. It’s big for us. We hit $2 million for the first time last year in late August. It’s taken us about 14 months to go up another half million. I don’t think I could have ever imagined our net worth increasing so much in such a small time frame. I feel incredibly lucky that the choices we made and the effort we put in to achieving FIRE has gotten us this far.

| Net Worth | FIRE Assets | |

| January 2021 | $2.15 M | $1.55 M |

| February 2021 | $2.18 M | $1.59 M |

| March 2021 | $2.23 M | $1.63 M |

| April 2021 | $2.29 M | $1.69 M |

| May 2021 | $2.32 M | $1.72 M |

| June 2021 | $2.36 M | $1.76 M |

| July 2021 | $2.40 M | $1.80 M |

| August 2021 | $2.44 M | $1.84 M |

| September 2021 | $2.44 M | $1.83 M |

| October 2021 | $2.50 M | $1.89 M |

FIRE Failure Indicators

Here’s our sanity check for the month.

- Is our spending on track? So far this year, we’ve spent about $45,088. If we do a simple projection on this to the end of the year (divide by 10, multiple by 12), it looks like we’ll spend about $54,105 in total. This is more than I’d thought originally when planning for FIRE. This increase is possibly due to health insurance premiums being more than expected during this transition period, but I’m not entirely sure. Spending about $54k per year isn’t terrible for us, but it’s higher than we want. I’ll have to look carefully at the end of the year and see where we’re spending past our estimates.

- Is our withdrawal rate okay? If Mr. FD were to stop working today, we’d have a withdrawal rate close to 3.00%. That’s right around where we want to be. Below is a table of withdrawal rates and equivalent withdrawal amounts given our current FIRE assets. We want to keep our spending at or below 3%, so we should be fine if and when Mr. FD decides to stop freelance work.

Withdrawal Rate Withdrawal Amount 4.00% $75,704 3.75% $70,972 3.50% $66,241 3.25% $61,509 3.00% $56,778 2.75% $52,046

Happiness Indicators

On a scale of 1-10, how would I rate my happiness? An 8!?

My little project is slowly progressing. I started playing around with Django, a python framework for web applications. I’d worked with Java and Ruby in the past, so this has been a fun change. Since we’re locked into another 3 years with our current web hosting service, I looked into what frameworks they supported on a shared hosting machine. Django was one of them. I’ve also been playing around with some simple machine learning projects. My models perform pretty badly, but it’s a start. I hope to eventually create some services and showcase my work. We’ll see how far I get before the Spring term in my grad program starts next year.

The pandemic. This has been weighing on me since it started, but I see the light at the end of the tunnel for us. The FDA approved Pfizer’s 5-11 year old vaccine for emergency use last week. We plan to get our kids vaccinated as soon as the CDC gives the green light. We’re excited that we may be able to do that soon. I’ll be able to breathe easier after the whole family is vaccinated. Also, we made it through our first round of colds and covid tests! (Yay.) We all tested negative, except for Mr. FD. He didn’t show any symptoms at all, so he didn’t bother getting tested. The kids had to be virtual for a bit before receiving the negative covid tests. In any case, we expected the kids to catch something after returning to school, and it wasn’t so bad.

Running has taken a hit due to everyone catching colds. I took about two weeks off to recover, and now I’m building back up again. I ran a 5-mile long run this past weekend. I’m hoping to increase this to 7 miles while continuing to work on speed and endurance.

Thanks for reading. Stay safe and healthy, Everyone!